Workplace Resources

Welcome to our one-stop-shop for young workers who want to learn more about their rights at work or who need assistance in resolving workplace issues.

Our workplace resources are designed for workers under 25.

With these you can check if you are getting paid correctly, find out your rights at work, and access a super easy guide to identifying wage theft and how to get your unpaid wages back.

Quick Scroll

Take me to:

Wage Theft Guide 💸

Wage theft is a crime at epidemic levels.

1 in 5 young workers are being paid less than the legal minimum wage they are entitled to.

So, if you think you’re wages have been stolen, you’re not alone!

This is a series about how to work it out, and what to do about it.

Contracts ✍️

So you’ve just been offered a job. Fantastic news!

First things first…

Let’s look at your employment contract.

Know Your Wages 💰

We totally get it… Finding out the correct wage you should be paid based on your industry, level or age can be confusing.

We’re here to help! Take a look at our current industries to find out your wages.

Know Your Rights ✊

The National Employment Standards (usually referred to as the NES) are a set of 10 minimum employment conditions that have to be provided to all full time and part time employees. Your Award or Agreement can’t contain clauses that reduce these standards.

Casual workers are only entitled to some of the conditions in the NES.

Full time

Hours

Full-time employees are entitled to 38 hours per week. Full-time employees may be required to work reasonable overtime hours, which generally incur overtime rates.

Benefits & Entitlements

- Maximum weekly hours

- Request for flexible working arrangements

- Paid parental leave

- Paid annual leave

- Paid personal and carers leave

- Paid family and domestic violence leave

- Paid community service leave

- Long service leave

- Public holiday leave, penalty rates, or time in lieu

- Notice of termination

- Receive a Fair Work Statement when you start working for a new employer

Dismissal

- Notice Requirements: Employers must give written notice when terminating employment, with some exceptions. Employees should check their award or contract for specific notice periods.

- Payment in Lieu of Notice: Employers can pay out the notice period instead of having the employee work it, ensuring the payment equals what would have been earned during the notice period.

- Termination on Probation: Employees on probation are still entitled to notice or payment in lieu based on their length of service.

- Serious Misconduct: No notice is required for termination due to serious misconduct, but all outstanding entitlements must be paid.

Superannuation

Under the super guarantee, employers have to pay super contributions of 11% of an employee’s ordinary time earnings when an employee is:

- over 18 years, or

- under 18 years and works over 30 hours a week.

- Full time, part time or casual

From 1 July 2024, the super guarantee, that is – the percentage of your wage that your employer is required to pay into your super account, will increase from 11.0% to 11.5%. The super guarantee will continue to rise in 0.5% increments until it reaches 12% in 2025.

The super your employers pay to you should ALWAYS be displayed on your payslips.

Part time

Hours

Part-time employees work less than 38 hours per week and their hours are usually regular each week.

Benefits & Entitlements

- Maximum weekly hours

- Request for flexible working arrangements

- Paid parental leave

- Paid annual leave

- Paid personal and carers leave

- Paid family and domestic violence leave

- Paid community service leave

- Long service leave

- Public holiday leave, penalty rates, or time in lieu

- Notice of termination

- Receive a Fair Work Statement when you start working for a new employer

Dismissal

- Notice Requirements: Employers must give written notice when terminating employment, with some exceptions. Employees should check their award or contract for specific notice periods.

- Payment in Lieu of Notice: Employers can pay out the notice period instead of having the employee work it, ensuring the payment equals what would have been earned during the notice period.

- Termination on Probation: Employees on probation are still entitled to notice or payment in lieu based on their length of service.

- Serious Misconduct: No notice is required for termination due to serious misconduct, but all outstanding entitlements must be paid.

Superannuation

Under the super guarantee, employers have to pay super contributions of 11% of an employee’s ordinary time earnings when an employee is:

- over 18 years, or

- under 18 years and works over 30 hours a week.

- Full time, part time or casual

From 1 July 2024, the super guarantee, that is – the percentage of your wage that your employer is required to pay into your super account, will increase from 11.0% to 11.5%. The super guarantee will continue to rise in 0.5% increments until it reaches 12% in 2025.

The super your employers pay to you should ALWAYS be displayed on your payslips.

Casual

Hours

Casual employees usually work irregular hours. A casual employee does not have a firm commitment in advance from their employer to ongoing work with an agreed pattern of work.

Benefits & Entitlements

- Unpaid carers leave

- Unpaid compassionate leave

- Unpaid community service leave

- Paid family and domestic violence leave

- Receive a Fair Work Statement when you start working for a new employer

If you have been employed as a casual for 12 months & it can be reasonably expected that your employment will continue, you are also entitled to:

- Request flexible working arrangements

- Parental leave

Dismissal

Casuals don’t get notice of termination or redundancy pay, even if they work regularly for a long time.

Superannuation

Under the super guarantee, employers have to pay super contributions of 11% of an employee’s ordinary time earnings when an employee is:

- over 18 years, or

- under 18 years and works over 30 hours a week.

- Full time, part time or casual

From 1 July 2024, the super guarantee, that is – the percentage of your wage that your employer is required to pay into your super account, will increase from 11.0% to 11.5%. The super guarantee will continue to rise in 0.5% increments until it reaches 12% in 2025.

The super your employers pay to you should ALWAYS be displayed on your payslips.

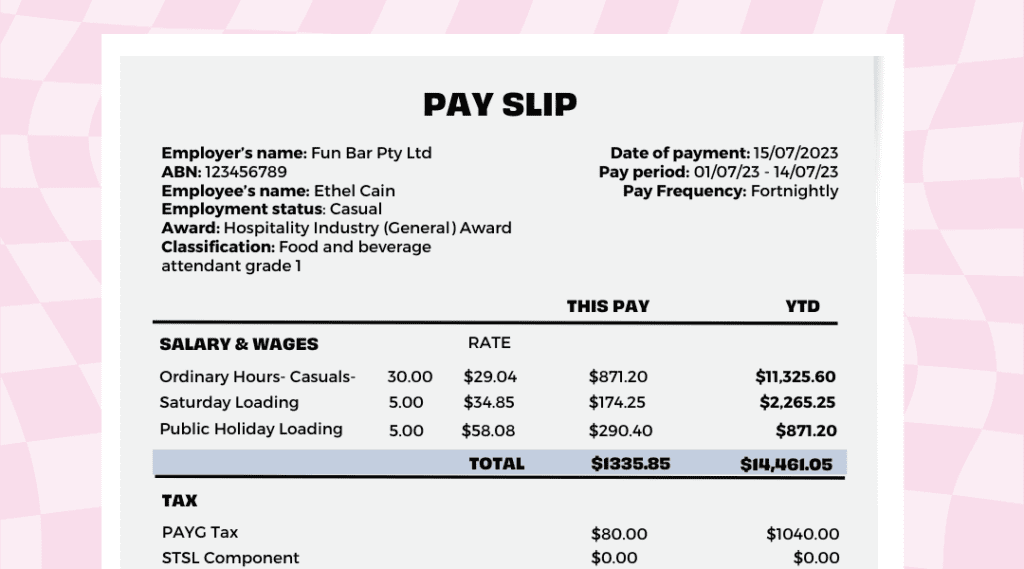

Payslips 🧾

They might be dull, but payslips are important.

For workers, they’re a checklist of how much you’re paid per hour, how many hours you worked in the pay period, how much super is owing, how much leave you have accrued and if you have any sick leave.

Let’s take a look at your payslip.

From The Blog 🔗

Check out our blog for other useful workplace content

Sign up to hear the latest from Gen United 📬

Full Disclaimer

The information provided on this website does not, and is not intended to, constitute legal advice; instead, all information, content, and materials available on this site are for general informational purposes only. Users should seek their own legal advice before relying on content on this website – if you are a UWU member, please contact the Union directly with your enquiry.

Gen United (United Workers Union) is committed to ensuring that information available through our workplace resources including data is accurate and incorporates changes to minimum rates of pay, allowances, penalty rates and workplace rights in the award as soon as they come into effect.

However, we cannot guarantee or accept any liability for the accuracy, reliability, currency or completeness of the information available in these workplace resources. This is because, for example, there may be a delay between when a change takes effect, and when the information available in these resources is updated.